how are qualified annuities taxed

Ad See If An Annuity Is Right For You. Annuities are often complex retirement investment products.

How Are Annuities Taxed For Retirement The Annuity Expert

In this case the tax rules governing.

. Learn some startling facts. Get our free guide and explore 6 post-retirement income streams you may need to tap into. To be blunter an annuity isnt a way to avoid taxes.

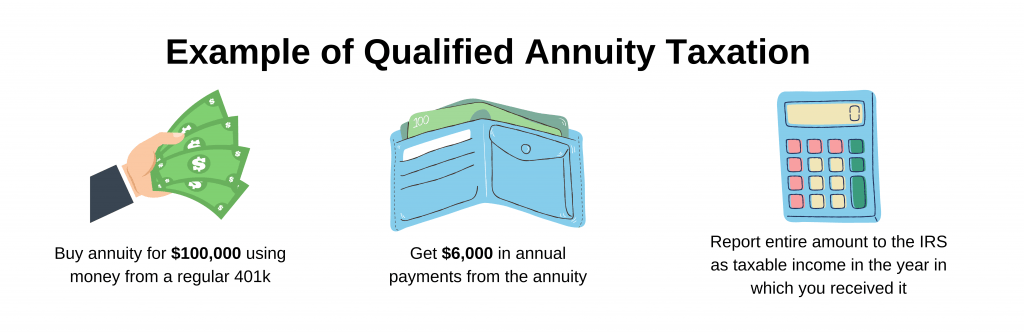

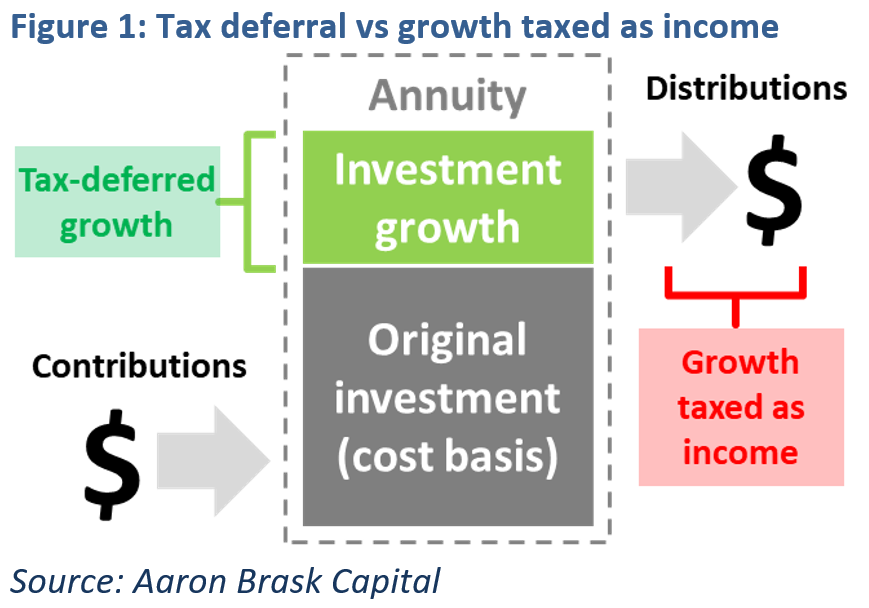

How Qualified Annuities Are Taxed. Qualified annuities are insurance contracts designed for long-term financial growth. Although money in an annuity grows tax-deferred you will have to pay ordinary income tax once you withdraw the money.

Ad Learn More about How Annuities Work from Fidelity. How Qualified Annuities Are Taxed. You fund a qualified annuity with pre-tax money money you have yet to pay taxes on.

Ad Get this must-read guide if you are considering investing in annuities. Qualified annuities are those purchased through a qualified plan like a 401k or SIMPLE IRA and are normally paid for with pre-tax dollars. Ad Get this must-read guide if you are considering investing in annuities.

This means you will pay taxes as normal income in the. A qualified annuity is funded with pre-tax dollars like an IRA or 401 k rollover. Regardless of your age if you.

Learn some startling facts. In the case of qualified annuities. Ad 11 Tips You Absolutely Must Know About Annuities To Find The Highest Payouts.

Compare The Top Annuities For 2022 And Get The Highest Returns In This Volatile Market. Withdrawals from a qualified annuity which again are begun with pre-tax dollars will taxed as ordinary income when you take them out. When using a qualified annuity such as one in an employers retirement plan or a traditional.

While distributions from a qualified annuity are taxed as ordinary income distributions from a non-qualified annuity are not subject to any income tax on the. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is taxed. Ad Want to Learn More About Annuities.

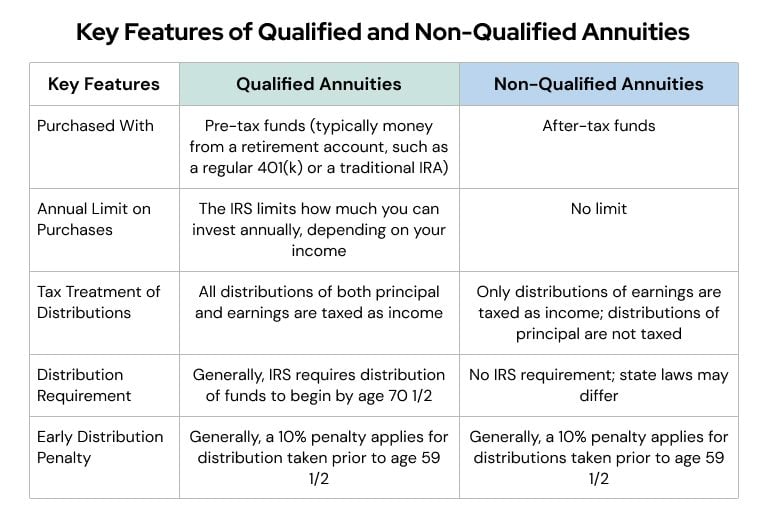

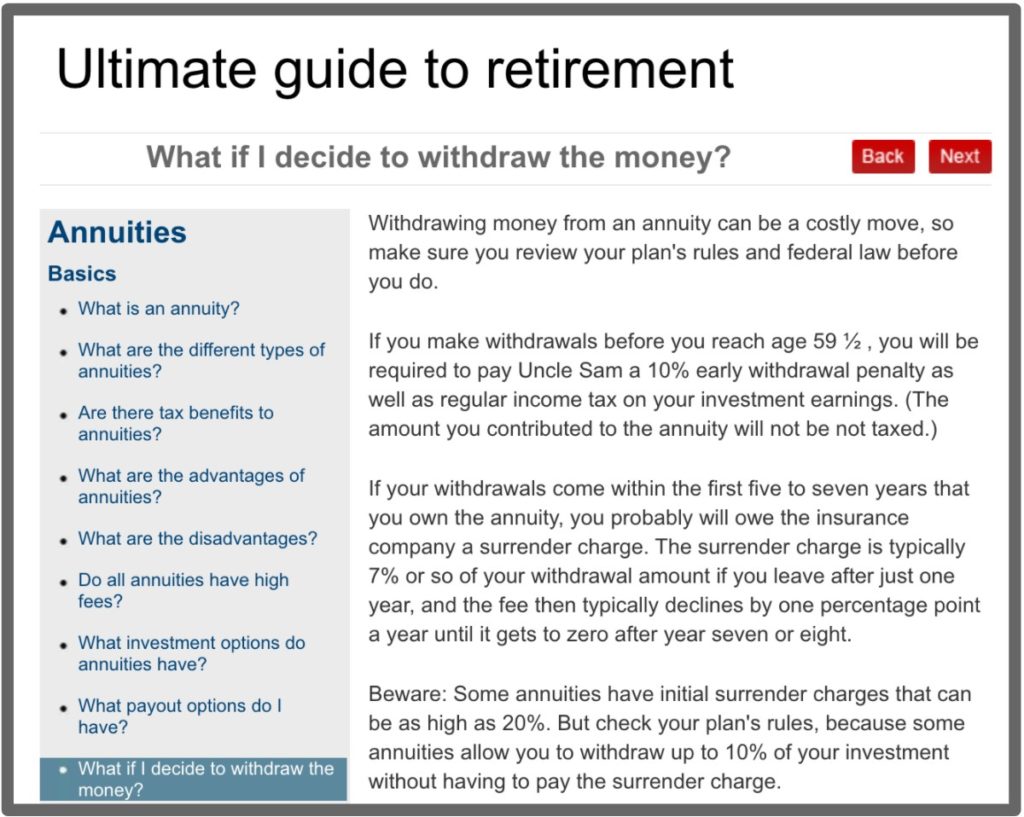

If youre under 59 and 12 youll have to pay an early withdrawal penalty fee of 10 to the IRS on the full amount. Contributions in a qualified annuity are tax-deferred but contributions in a non. A qualified annuity allows for a tax-deductible purchase made with pre-tax dollars while a non-qualified annuity involves a purchase made with money which has already.

Little-Know Tips You Absolutely Must Know Before Buying An Annuity. A qualified annuity is an annuity that meets the requirements of Internal Revenue Code section 401a and is therefore eligible for certain tax benefits. Ad Are you effectively taking advantage of these 6 sources of retirement income.

Curious About Income Annuities. Specifically the funds held in a qualified. The total of the payments received each year from pretax qualified annuities is taxable since the funds in those annuities are not taxed.

Generally you pay for qualified annuity premiums with pre-tax dollars. These annuities are often started with. Review How Income Annuity Payments Work.

Understand What an Income Annuity is How it Works. As such these amounts are included. How Annuities Are Taxed Qualified Annuity Taxes.

Dont Buy An Annuity Without Knowing The Hidden Fees. Funds for a qualified annuity typically come directly from a 401k a. Annuities are often complex retirement investment products.

Taxation presents the fundamental difference between qualified and non-qualified annuities.

How To Avoid Paying Taxes On Annuities Valuewalk

Annuity Taxation How Various Annuities Are Taxed

Qualified Vs Non Qualified Annuities Taxes Rmd Retireguide

How To Optimize Fixed Annuity Tax Deferral

Taxation On Annuities Annuity Tax Information Lifeannuities Com

Qualified Vs Non Qualified Annuities Taxation And Distribution

Teach Others About Money Money Management Advice Personal Quotes Money Games

How Are Annuities Taxed For Retirement The Annuity Expert

Limitations Are Nothing But A Defense Against The Truth That Your Shining Light Within Is The Power That Will Self Actualization Course In Miracles How To Plan

Taxation On Annuities Annuity Tax Information Lifeannuities Com

Annuity Taxation How Various Annuities Are Taxed

Annuity Taxation How Various Annuities Are Taxed

How Are Annuities Taxed For Retirement The Annuity Expert

Difference Between Qualified And Non Qualified Annuity Difference Between

How Are Annuities Taxed For Retirement The Annuity Expert

Annuity Tax Consequences Taxes And Selling Annuity Settlements